When it comes to long-term health, knowledge about chronic benefits becomes indispensable, especially in South Africa where medical schemes and health insurances do not always provide equal protection. If you or your loved one has a chronic condition such as diabetes, asthma, hypertension, or mental health diagnosis, knowing your rights becomes a matter of proper treatment versus financial stress.

This blog will explain what the Prescribed Minimum Benefits (PMBs) are, how the Chronic Disease List (CDL) affects medical aid and mental health cover, what you can expect from mental health care, and the major differences between medical aid and health insurance.

What is Prescribed Minimum Benefits?

Prescribed minimum benefits or PMBs, are a set of 271 conditions that are covered by all medical aids in South Africa regardless of the plan you are on. These are the minimum benefits your medical aid must pay for by law.

PMBs are divided into three main categories:

- 271 Diagnosis and Treatment Pairs (DTPs): These are 271 conditions that have a specific medical diagnosis, each paired with a standardised treatment plan. Medical aid schemes are required to pay for the treatment of these conditions.

- 26 Chronic Disease List (CDL) Conditions: These include 26 long-term, manageable illnesses such as Diabetes, HIV, and Bipolar Mood Disorder, etc. Medical aids are required to provide diagnosis, treatment, and ongoing care for these conditions.

- Emergency PMB: These cover life-threatening medical situations where immediate treatment is needed to prevent serious harm or death. Medical schemes are obligated to cover the cost of emergency treatment. If you use a non-network hospital, you may be subject to co-payments unless there is no network hospital within 40 kilometres of your location.

What chronic conditions are protected under prescribed minimum benefits?

PMBs are the basic set of services the open medical schemes must legally cover for all their members, irrespective of contribution level or plan type.

The PMB list includes 271 PMB conditions and an additional 26 conditions which are classified as chronic diseases. Examples of these are epilepsy, diabetes, asthma, hypertension, bipolar mood disorder, and schizophrenia. Schemes must cover these at the PMB level of care, but members should know that using non-formulary medicines or non-designated providers may result in co-payments.

How the chronic disease list determines what your scheme must pay for

The Chronic Disease List (CDL) is an official list of 26 chronic conditions. It includes a wide range of illnesses, from cardiovascular disease to HIV, and even certain mental health conditions.

This list is more than just a reference: it’s a legal standard. Your medical aid scheme is obligated to provide treatment and medication for these conditions, typically guided by treatment algorithms set by the Council for Medical Schemes (CMS). Members can get treated for each of these conditions, but it is only the 26 chronic conditions that will be covered as “Prescribed Minimum Benefits” by the medical plan.

Important: While schemes must cover the conditions on the CDL, the type and brand of medication, or the specialists you can visit, may be subject to scheme rules. Always read the fine print.

How mental health is treated under chronic benefits

Only certain mental health conditions, such as bipolar mood disorder and schizophrenia, are explicitly listed under the Chronic Disease List (CDL). Depression and anxiety are not included in the official CDL list of 26 chronic conditions.

It’s important to understand that Prescribed Minimum Benefits are defined by conditions that threaten your life or quality of life, so not all mental health treatments automatically qualify. If your medical scheme provides cover for depression or anxiety outside of CDLs, this is usually part of their Non-Chronic Disease List (Non-CDL) benefits, which often come with specified annual limits.

Depression and anxiety are not on the CDL list, so they’re not automatically covered as PMBs in the same ongoing, outpatient manner. However, they can still be treated as PMBs in specific circumstances, particularly if they present as:

- A mental health emergency (e.g. psychotic episodes, or severe breakdowns).

- A comorbidity of another PMB condition.

- Conditions resulting in involuntary admission or hospitalisation under the Mental Health Care Act.

Because CDLs are a fixed legal standard, schemes cannot offer extra CDLs but may provide additional benefits beyond those minimum requirements. Clear understanding of these distinctions ensures you know exactly what your plan covers.

MedicalAid.co.za makes this process easy by allowing you to select if you want to include chronic medication in your comparison or not.

When choosing medical aid mental health cover, it’s important to find out whether your scheme includes therapy and psychiatric consultations, and how these are covered. Many schemes don’t just limit the number of sessions; instead, they set a rand value limit. For example, a plan might cover “2 specialist visits or R4,500 per year,” whichever comes first. Some may allow a certain number of visits but cap the total amount they’ll pay, such as covering 2 visits up to R1,500, with any costs beyond that being your responsibility. This is often because specialist consultations can be quite expensive, and medical aids aim to manage those costs carefully. Many members aren’t aware that specific ongoing mental health treatment can be claimed from your chronic benefits, so it’s important to ensure that your condition is registered to avoid out-of-pocket surprise expenses.

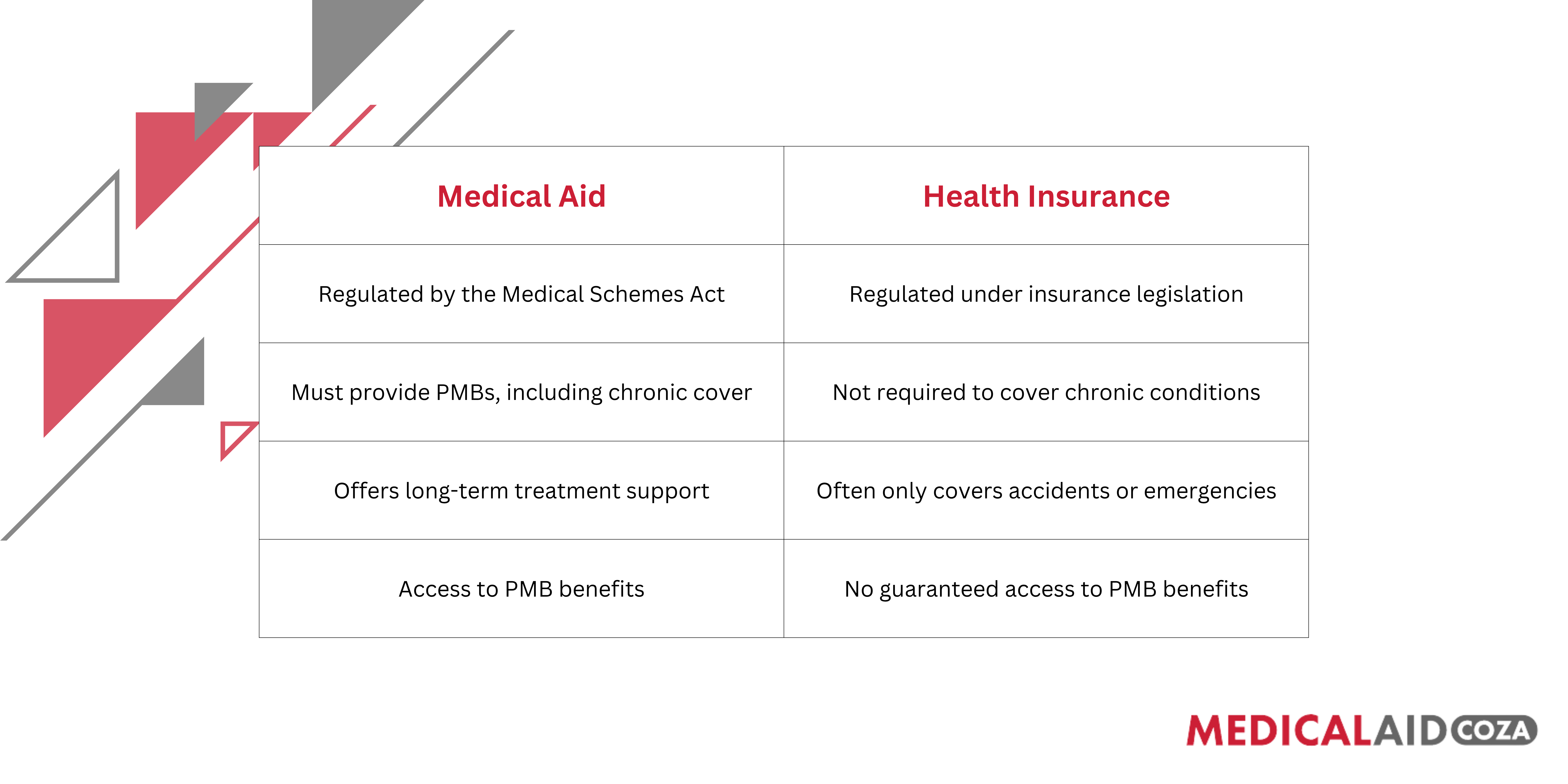

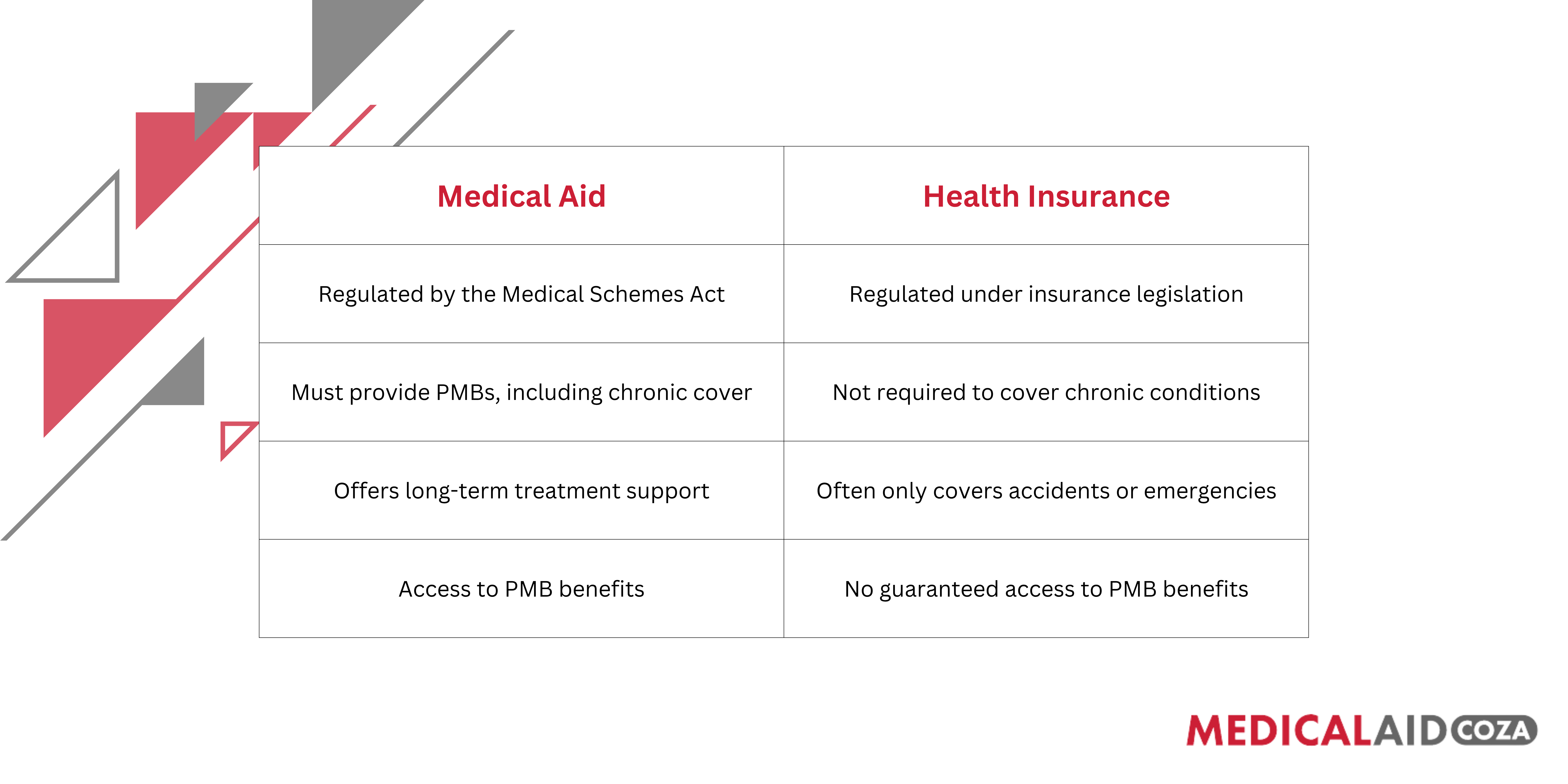

Medical aid vs health insurance: What’s the difference when it comes to chronic care?

Medical aid vs health insurance: What’s the difference when it comes to chronic care?

It’s common to confuse medical aid and health insurance, but when it comes to chronic conditions, the difference matters.

If you are managing a long-term illness, health insurance alone is not enough. It won’t provide the same guaranteed access to treatment as medical aid does. It is also important to note that medical insurance usually does offer cover for some chronic conditions, and as a result they do offer limited cover for chronic medication and for specialist visits. It varies according to the insurance plan.

What the Council for Medical Schemes says about your rights to chronic care

The Council for Medical Schemes (CMS) is the regulatory body that protects the rights of members of medical aids. They ensure all schemes follow the law and honour their obligations around chronic benefits.

Final thoughts

Final thoughts

If you or someone in your family is living with a chronic condition, don’t leave your healthcare to chance. Whether it’s managing high blood pressure, mental health conditions, or diabetes, it’s critical to understand what your medical aid must legally provide.

Medical schemes are bound by law to offer PMBs and cover for the 26 CDL conditions and 271 PMB conditions. But not all plans offer equal value, and health insurance might not give you the same protection.

Before you renew or sign up for a new plan, read a recent post

compare your options and make sure your scheme supports your long-term needs. Start with a

MedicalAid.co.za quote today to find affordable medical aid quotes that include the chronic benefits you deserve.

Get a Free Medical Aid Quote

Medical aid vs health insurance: What’s the difference when it comes to chronic care?

It’s common to confuse medical aid and health insurance, but when it comes to chronic conditions, the difference matters.

Medical aid vs health insurance: What’s the difference when it comes to chronic care?

It’s common to confuse medical aid and health insurance, but when it comes to chronic conditions, the difference matters.

If you are managing a long-term illness, health insurance alone is not enough. It won’t provide the same guaranteed access to treatment as medical aid does. It is also important to note that medical insurance usually does offer cover for some chronic conditions, and as a result they do offer limited cover for chronic medication and for specialist visits. It varies according to the insurance plan.

What the Council for Medical Schemes says about your rights to chronic care

The Council for Medical Schemes (CMS) is the regulatory body that protects the rights of members of medical aids. They ensure all schemes follow the law and honour their obligations around chronic benefits.

If you are managing a long-term illness, health insurance alone is not enough. It won’t provide the same guaranteed access to treatment as medical aid does. It is also important to note that medical insurance usually does offer cover for some chronic conditions, and as a result they do offer limited cover for chronic medication and for specialist visits. It varies according to the insurance plan.

What the Council for Medical Schemes says about your rights to chronic care

The Council for Medical Schemes (CMS) is the regulatory body that protects the rights of members of medical aids. They ensure all schemes follow the law and honour their obligations around chronic benefits.

Final thoughts

If you or someone in your family is living with a chronic condition, don’t leave your healthcare to chance. Whether it’s managing high blood pressure, mental health conditions, or diabetes, it’s critical to understand what your medical aid must legally provide.

Medical schemes are bound by law to offer PMBs and cover for the 26 CDL conditions and 271 PMB conditions. But not all plans offer equal value, and health insurance might not give you the same protection.

Before you renew or sign up for a new plan, read a recent post compare your options and make sure your scheme supports your long-term needs. Start with a MedicalAid.co.za quote today to find affordable medical aid quotes that include the chronic benefits you deserve.

Get a Free Medical Aid Quote

Final thoughts

If you or someone in your family is living with a chronic condition, don’t leave your healthcare to chance. Whether it’s managing high blood pressure, mental health conditions, or diabetes, it’s critical to understand what your medical aid must legally provide.

Medical schemes are bound by law to offer PMBs and cover for the 26 CDL conditions and 271 PMB conditions. But not all plans offer equal value, and health insurance might not give you the same protection.

Before you renew or sign up for a new plan, read a recent post compare your options and make sure your scheme supports your long-term needs. Start with a MedicalAid.co.za quote today to find affordable medical aid quotes that include the chronic benefits you deserve.

Get a Free Medical Aid Quote