You’re on a student plan. Or a family option you chose years ago. But now your needs have changed. The benefits no longer match your lifestyle. The costs feel harder to justify and you start asking if your current medical aid still fits. That’s usually the first sign it’s time to reassess your cover.

In this blog, you’ll learn when it makes sense to upgrade, what rules apply, and how to compare options without pressure. The goal is to help you make the right choice for where you are now.

Understanding medical aid upgrades

Upgrading a medical aid doesn’t always mean switching providers.

In most cases, it means moving to a different option within the same medical scheme.

Medical schemes offer multiple options. These options differ in:

- Benefits: What is covered, and how much.

- Monthly contributions: What you pay.

- Structure: Day-to-day benefits vs hospital cover, savings, limits.

All schemes follow rules set by the Council for Medical Aid (CMS). These rules create fairness across schemes. At the same time, schemes build options in different ways.

This distinction affects what you pay and what you’re covered for. In most cases, an upgrade means adjusting your option within the same scheme.

Common life changes that may trigger a review

Changes in your life often mean changes in your medical needs. Let’s look at some common triggers.

Changes in family structure:

- Getting married or starting a family

- Adding children or other dependants to your plan

- Moving into a new phase of life

- Your child becomes an adult dependant

These shifts require wider benefits, once you start planning for a family you’ll need maternity cover, and as your household grows your cover needs to keep up with their healthcare needs.

Changes in income or employment:

- Moving from finishing your studies to now working full-time

- Earning more than before. An average of 10% of your income should go to medical aid.

This can shift what’s affordable and what you expect from your cover. A starter option may no longer meet your needs.

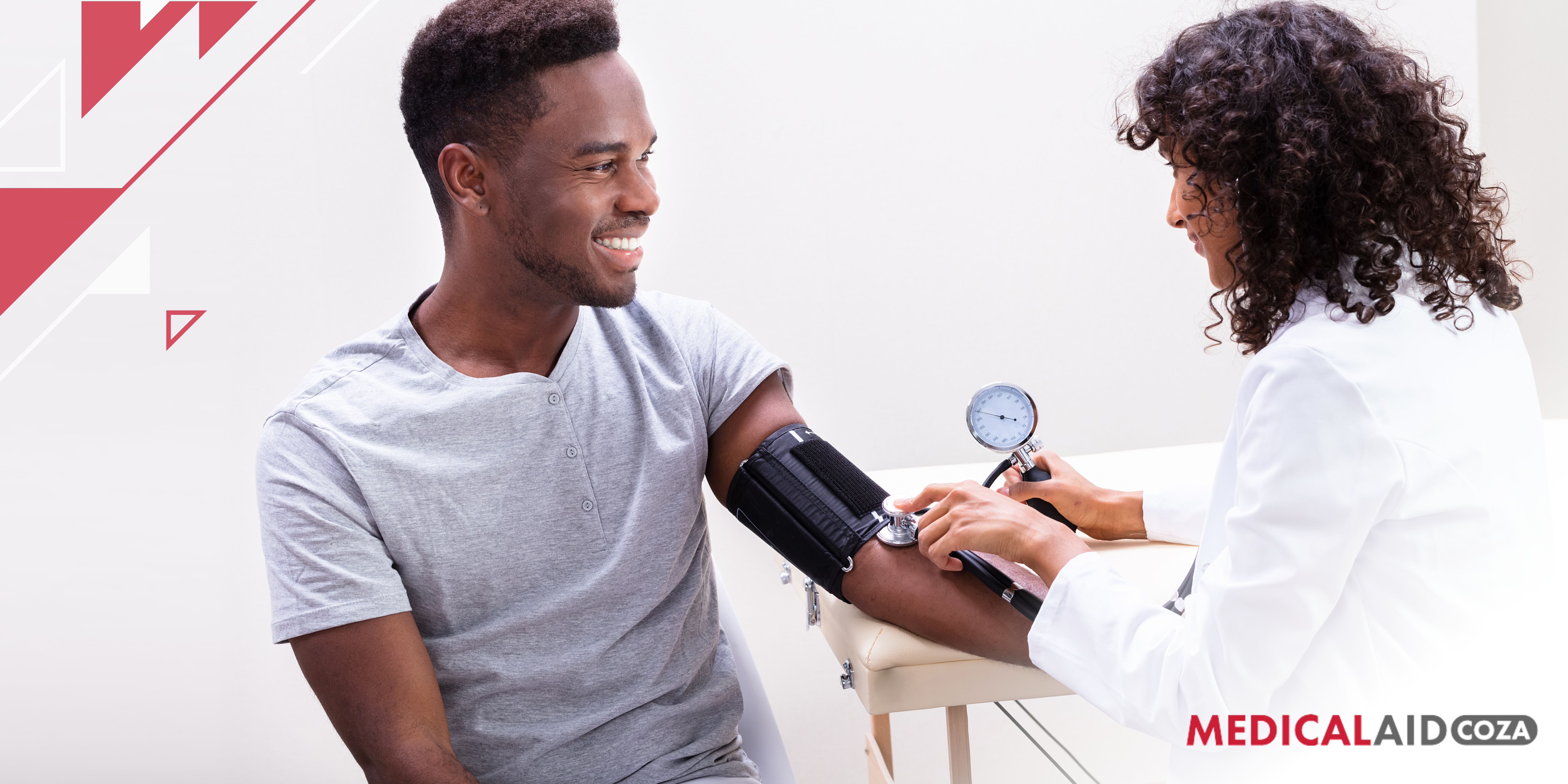

Changes in healthcare usage

- More frequent General Practitioner (GP) visits

- Chronic medication or new diagnoses

- Planning a procedure

- Moving to a new town

If your current option limits how often you can claim, or what’s covered, it may be time to explore alternatives.

Are you allowed to upgrade your medical aid at any time?

Medical aid changes are regulated by the CMS. Generally, most schemes allow option changes once a year, during the medical aid review period (usually towards the end of the year).

However, certain life events may allow changes outside that window. This depends on your scheme’s rules. For example:

- Getting married

- Having a baby

- Changing jobs

Always check with your scheme to see what’s allowed. Remember, scheme rules apply, and changes may be possible, but it’s not guaranteed. You will need a letter of motivation to switch plans outside of the benefit review period.

Signs your current option may no longer suit you

It’s not always obvious that your plan no longer fits. Here are a few signs it may be time to review your benefits:

- You’re paying for benefits you don’t use

- You often reach your benefit limits

- You’ve had a major life change since joining

- Your healthcare needs have increased

If these points feel familiar, reviewing options based on your current life situation helps.

Why comparing options is a smart first step

Upgrading is not the same as switching. Just looking at other options can give you clarity, without any commitment.

Here’s why comparing options helps:

- You see benefits and costs side by side

- You can assess which benefits matter most to you

- You avoid overpaying for cover you don’t use

If you’re unsure if your current option still fits your needs, it may help to view your options based on your personal details.

How Medicalaid.co.za helps you review your options

Medicalaid.co.za offers a free, easy-to-use tool to compare medical aid options.

Here’s how it works:

- Based on your age, income and family size

- Shows real monthly contribution amounts

- Explains benefits clearly, with hover-over tips

- Designed to support informed choices, not to sell you a specific plan

This can help you understand which options suit your current life stage.

Use the Medicalaid.co.za comparison tool to view options that align with your current life stage.

Take a moment before you decide

You don’t need to upgrade your medical aid. But you should know if your current option still fits. Looking at your options is not a commitment. It’s a step toward clarity.

Here’s what matters:

- Upgrading is your decision

- Comparing options puts you in control

- Knowing what you pay for helps you choose better

If you’ve started a new job, added a dependant, or your healthcare needs have changed, it’s time to review.

Use Medicalaid.co.za’s comparison tool to see which options match your life today.

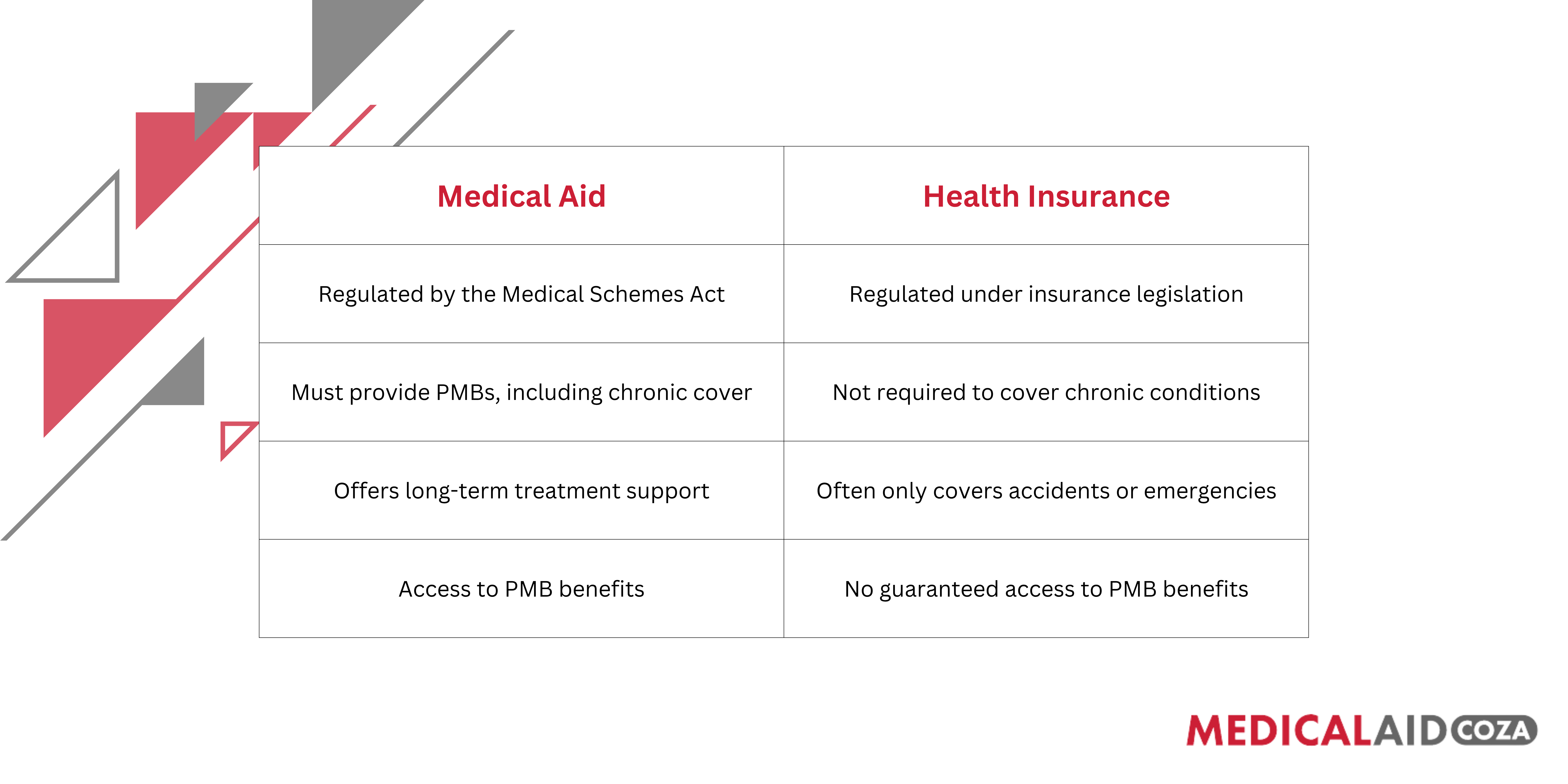

Medical aid vs health insurance: What’s the difference when it comes to chronic care?

It’s common to confuse medical aid and health insurance, but when it comes to chronic conditions, the difference matters.

Medical aid vs health insurance: What’s the difference when it comes to chronic care?

It’s common to confuse medical aid and health insurance, but when it comes to chronic conditions, the difference matters.

If you are managing a long-term illness, health insurance alone is not enough. It won’t provide the same guaranteed access to treatment as medical aid does. It is also important to note that medical insurance usually does offer cover for some chronic conditions, and as a result they do offer limited cover for chronic medication and for specialist visits. It varies according to the insurance plan.

What the Council for Medical Schemes says about your rights to chronic care

The Council for Medical Schemes (CMS) is the regulatory body that protects the rights of members of medical aids. They ensure all schemes follow the law and honour their obligations around chronic benefits.

If you are managing a long-term illness, health insurance alone is not enough. It won’t provide the same guaranteed access to treatment as medical aid does. It is also important to note that medical insurance usually does offer cover for some chronic conditions, and as a result they do offer limited cover for chronic medication and for specialist visits. It varies according to the insurance plan.

What the Council for Medical Schemes says about your rights to chronic care

The Council for Medical Schemes (CMS) is the regulatory body that protects the rights of members of medical aids. They ensure all schemes follow the law and honour their obligations around chronic benefits.

Final thoughts

If you or someone in your family is living with a chronic condition, don’t leave your healthcare to chance. Whether it’s managing high blood pressure, mental health conditions, or diabetes, it’s critical to understand what your medical aid must legally provide.

Medical schemes are bound by law to offer PMBs and cover for the 26 CDL conditions and 271 PMB conditions. But not all plans offer equal value, and health insurance might not give you the same protection.

Before you renew or sign up for a new plan, read a recent post

Final thoughts

If you or someone in your family is living with a chronic condition, don’t leave your healthcare to chance. Whether it’s managing high blood pressure, mental health conditions, or diabetes, it’s critical to understand what your medical aid must legally provide.

Medical schemes are bound by law to offer PMBs and cover for the 26 CDL conditions and 271 PMB conditions. But not all plans offer equal value, and health insurance might not give you the same protection.

Before you renew or sign up for a new plan, read a recent post

Common exclusions in medical aid plans

Exclusions are treatments or procedures your plan won’t cover at all – no matter your overall limit or benefit tier. Typical medical aid exclusions include:

Common exclusions in medical aid plans

Exclusions are treatments or procedures your plan won’t cover at all – no matter your overall limit or benefit tier. Typical medical aid exclusions include:

How to compare medical aid plans effectively

Making sense of all this is no easy task, but the right tools make all the difference. If you’re doing a medical aid comparison in South Africa, be sure to:

How to compare medical aid plans effectively

Making sense of all this is no easy task, but the right tools make all the difference. If you’re doing a medical aid comparison in South Africa, be sure to:

Bottom line: Your health (and wallet) deserves better

The key takeaway? You don’t have to wait for a crisis, or the end of the year, to take control of your cover. Whether it’s a lifestyle change, a financial shakeup, or just a gut feeling that your benefits aren’t up to scratch, knowing when to compare medical aid plans in South Africa is one of the smartest preventative care moves you can make.

Bottom line: Your health (and wallet) deserves better

The key takeaway? You don’t have to wait for a crisis, or the end of the year, to take control of your cover. Whether it’s a lifestyle change, a financial shakeup, or just a gut feeling that your benefits aren’t up to scratch, knowing when to compare medical aid plans in South Africa is one of the smartest preventative care moves you can make.